- Home

- About

- Education

- Discover Education

- Undergraduate

- Prospective Students

- Student Life

- Undergraduate Overseas Elective Programme (Inbound)

- Graduate Studies

- Graduate Studies and MDS Specialist Committees

- Prospective Graduate Students

- Clinical Attachment Programme

- MDS Residency Programmes

- Endodontics

- Oral & Maxillofacial Surgery

- Orthodontics

- Paediatric Dentistry

- Periodontology

- Prosthodontics

- Graduate Diploma Courses

- Dental Implantology

- Geriatric Dentistry

- Graduate Degree (Research)

- Master of Science (MSc)

- Doctor of Philosophy (PhD)

- Lifelong Learning (CADE)

- Student Support

- Scholarships & Financial Aid

- Student Achievements

- Research

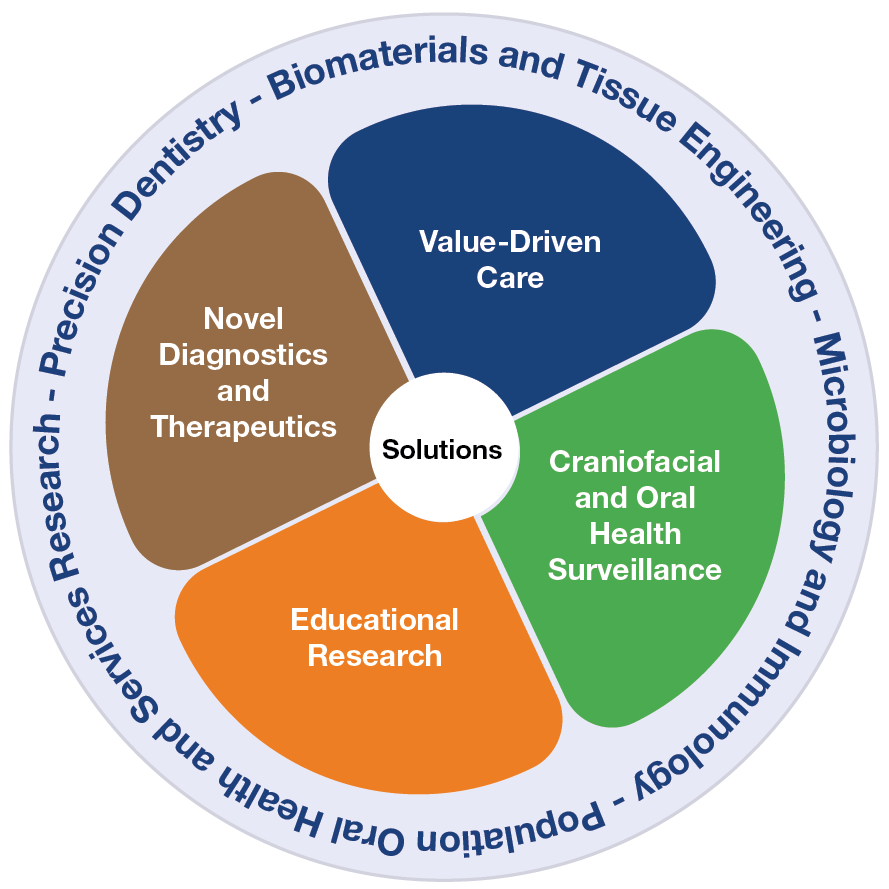

- Research Thrusts

- Graduate Degree (Research)

- Master of Science (MSc)

- Doctor of Philosophy (PhD)

- Research Groups

- Biomaterials and Tissue Engineering

- Microbiology and Immunology

- Population Oral Health and Services Research

- Precision Dentistry

- Oral Care, Health Innovations and Designs Singapore (ORCHIDS)

- Resources

- Biostatistics

- Clinical Research Unit

- Research Administration

- Research Laboratory

- Achievements

- Clinical Services

- Giving

- Alumni

- News

- Events

- Press

- Contact Us

- Tax Benefits

- Naming Opportunities

- Recognition

Singapore Tax residents are eligible for a tax deduction that is 2.5 times the gift value for gifts made in year 2021 – 2023. When the tax deduction for the donation is more than your taxable income (for both individuals and companies) for the year, the donor is allowed to carry forward the unutilised deductions for a maximum of 5 years.

For example, a donation made in 2011, and allowed for deduction in YA 2012, will be allowed to be carried forward (if tax deduction for the donation exceeds the income for 2011) up to YA 2017.

For more information on tax deductibles, including details on different types of donations and how to claim deductions, please visit https://www.iras.gov.sg/IRASHome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals/Donations/.

To recognise the generosity of our donors, NUS offers naming opportunities. You can make a gift to honour individuals such as mentors or loved ones, or corporations or foundations.

Your contribution may be acknowledged by the NUS community through our internal publications and website.